In today’s digital world, scams have taken on increasingly sophisticated forms, preying on individuals who are often unaware of the dangers lurking online. One such emerging scheme gaining attention is “The Genius Wave Scam.” While the name suggests innovation and brilliance, this scam is anything but. In this article, we will delve deep into what the scam entails, how it operates, and most importantly, how you can protect yourself from falling victim to it.

What Is “The Genius Wave Scam”?

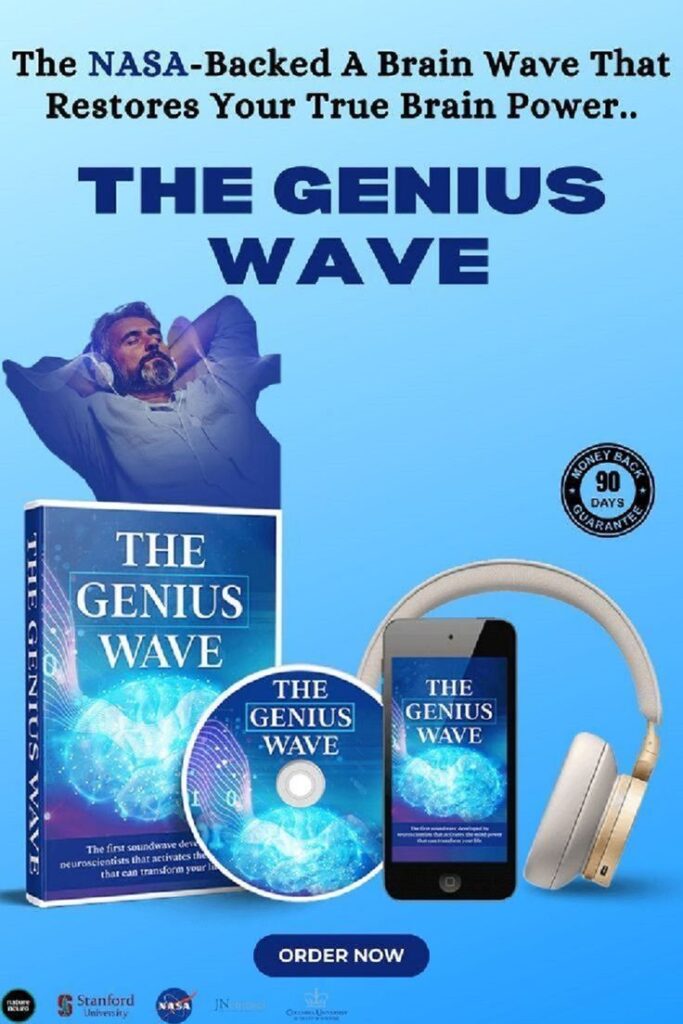

The Genius Wave Scam is a deceptive scheme designed to lure victims into investing in fraudulent projects, products, or services. It often masks itself under the guise of cutting-edge technology, promising high returns or unique benefits. The perpetrators leverage the name “genius” to project a sense of reliability and innovation, while “wave” suggests a sweeping trend everyone must join to avoid missing out.

At its core, this scam relies on exploiting human psychology—specifically the fear of missing out (FOMO). By presenting themselves as pioneers of a new technological or financial frontier, scammers manipulate their victims into acting quickly, bypassing critical thinking.

How the Scam Operates

- Sophisticated Marketing Tactics

The scammers behind The Genius Wave Scam use highly polished marketing materials to lure unsuspecting individuals. Their websites are often professional and filled with technical jargon designed to confuse and impress. Testimonials, fake news articles, and even fabricated celebrity endorsements are common. - Promises of High Returns

One hallmark of the scam is the promise of unrealistic returns on investment. Phrases like “guaranteed profit,” “risk-free investment,” or “revolutionary technology” are used to entice victims. These claims, however, lack substantiation and are crafted to play on the emotions of potential investors. - Pressure Tactics

Scammers create a sense of urgency by claiming the opportunity is available for a limited time or that spots are filling up quickly. This high-pressure approach forces victims to act impulsively, reducing the likelihood of due diligence. - Lack of Transparency

Victims often find it difficult to obtain clear answers about how the scheme operates. Details about the business model, technology, or investment process are vague, and when pressed, the scammers may deflect or provide convoluted explanations. - Disappearing Act

Once the scammers have collected enough money, they vanish without a trace, leaving victims unable to recover their investments.

Red Flags to Watch Out For

Identifying scams like The Genius Wave Scam requires vigilance and a keen eye for inconsistencies. Here are some warning signs:

- Unrealistic Claims: If an investment opportunity seems too good to be true, it probably is. Guaranteed returns or risk-free investments are major red flags.

- High-Pressure Sales Tactics: Be wary of any opportunity that pressures you to act immediately without giving you time to research.

- Lack of Verifiable Information: If the company or project behind the opportunity has no credible track record, this is a clear warning sign.

- Anonymous or Untraceable Founders: Legitimate businesses usually have transparent leadership. If the people behind the opportunity are hard to identify or contact, think twice.

- Overuse of Buzzwords: Scammers often use industry buzzwords to sound legitimate without providing concrete details.

How to Protect Yourself

- Research Thoroughly

Before investing in any opportunity, conduct extensive research. Look for independent reviews, verify the legitimacy of the company, and check whether the opportunity is registered with regulatory authorities. - Consult Professionals

If you’re unsure about an investment, consult a financial advisor or legal professional. They can help you evaluate the legitimacy of the opportunity. - Avoid Sharing Personal Information

Scammers often request sensitive information under the guise of setting up accounts or processing payments. Be cautious about sharing personal or financial details. - Report Suspicious Activities

If you suspect you’ve encountered The Genius Wave Scam or a similar scheme, report it to relevant authorities. In the U.S., for example, you can file a complaint with the Federal Trade Commission (FTC). - Trust Your Instincts

If something feels off about an opportunity, trust your gut. It’s better to miss a genuine opportunity than to fall victim to a scam.

Real-Life Examples of Similar Scams

While specific details about The Genius Wave Scam may still be emerging, it bears resemblance to other notorious scams in recent history. For instance, Ponzi schemes and pyramid schemes have long used similar tactics to deceive investors.

One infamous example is the Bernie Madoff Ponzi Scheme, where investors were promised steady, high returns. Madoff operated his fraudulent scheme for decades, ultimately costing victims billions of dollars.

Similarly, the rise of cryptocurrency has seen scams like Bitconnect, which promised astronomical returns but ultimately collapsed, leaving thousands of investors in financial ruin.

The Psychological Impact on Victims

Falling victim to a scam like The Genius Wave Scam can have devastating consequences beyond financial loss. Victims often experience feelings of shame, guilt, and mistrust, which can lead to mental health challenges.

It’s important to remember that scams are designed to deceive even the most cautious individuals. If you or someone you know has been affected, seek support from trusted friends, family, or professional counselors.

The Role of Technology in Preventing Scams

Technology, while often exploited by scammers, can also be a powerful tool for prevention. Artificial intelligence (AI) and machine learning can help detect fraudulent patterns and alert potential victims. Additionally, educational campaigns on social media platforms can raise awareness about scams like The Genius Wave Scam, empowering individuals to protect themselves.

Conclusion

The Genius Wave Scam serves as a stark reminder of the importance of vigilance in an increasingly connected world. By understanding how such scams operate and recognizing the red flags, you can protect yourself and your loved ones from financial deception.

Stay informed, ask questions, and never let the fear of missing out cloud your judgment. In the end, a cautious approach is the best defense against scams that prey on trust and ambition.

AL|Alabama AK|Alaska AZ|Arizona AR|Arkansas CA|California CO|Colorado CT|Connecticut DE|Delaware FL|Florida GA|Georgia HI|Hawaii ID|Idaho IL|Illinois IN|Indiana IA|Iowa KS|Kansas KY|Kentucky LA|Louisiana ME|Maine MD|Maryland MA|Massachusetts MI|Michigan MN|Minnesota MS|Mississippi MO|Missouri MT|Montana NE|Nebraska NV|Nevada NH|New Hampshire NJ|New Jersey NM|New Mexico NY|New York NC|North Carolina ND|North Dakota OH|Ohio OK|Oklahoma OR|Oregon PA|Pennsylvania RI|Rhode Island SC|South Carolina SD|South Dakota TN|Tennessee TX|Texas UT|Utah VT|Vermont VA|Virginia WA|Washington WV|West Virginia WI|Wisconsin WY|Wyoming DC|District of Columbia AS|American Samoa GU|Guam MP|Northern Mariana Islands PR|Puerto Rico UM|United States Minor Outlying Islands VI|Virgin Islands, U.S.